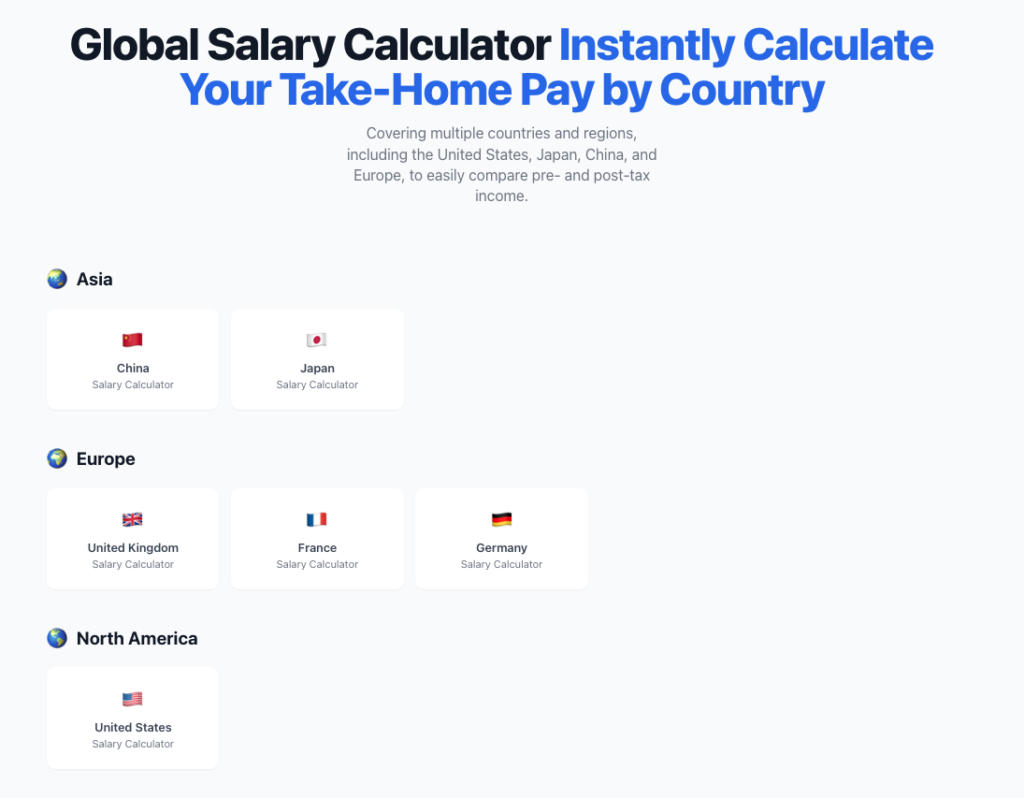

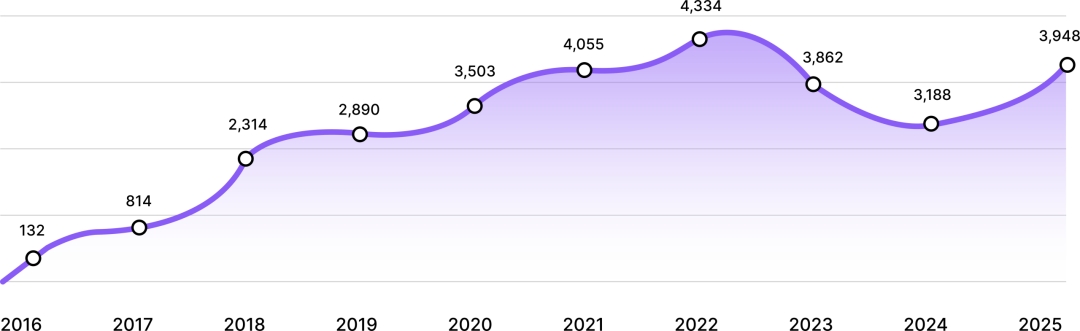

NEW YORK, NY – February 5, 2026 — SalaryCalculator.ai announced the availability of its artificial intelligence–based salary calculation platform designed to help users better understand how gross income translates into net earnings after taxes and mandatory deductions across multiple countries.

According to the company, the platform was developed in response to growing workforce mobility, remote employment, and cross-border job opportunities, which have increased demand for clearer insight into how compensation is affected by local tax structures and statutory payroll contributions.

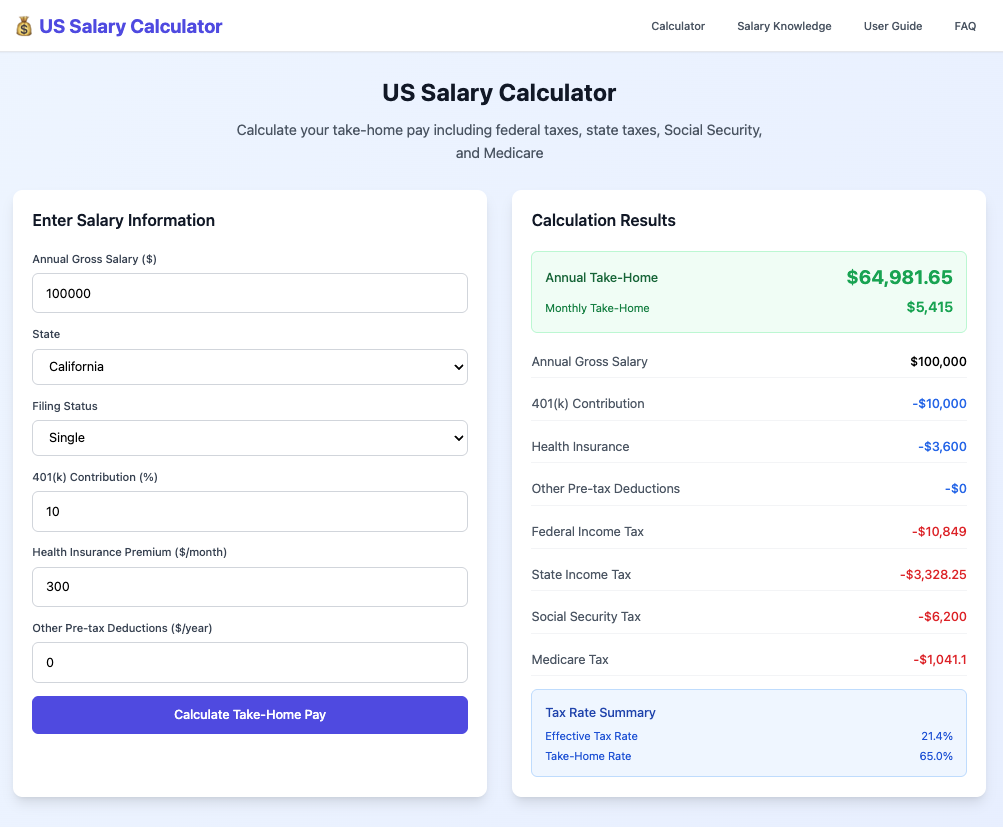

SalaryCalculator.ai allows users to input salary information and receive estimated net income calculations based on country-specific tax rules, social security contributions, and standard payroll deductions. The company stated that the tool is intended to provide transparency around take-home pay rather than replace professional tax or financial advice.

“Understanding actual earnings has become more complex as work becomes increasingly global,” a SalaryCalculator.ai spokesperson said. “Our platform is designed to help users see how taxes and required contributions affect income in different jurisdictions, using data-informed estimates aligned with local payroll frameworks.”

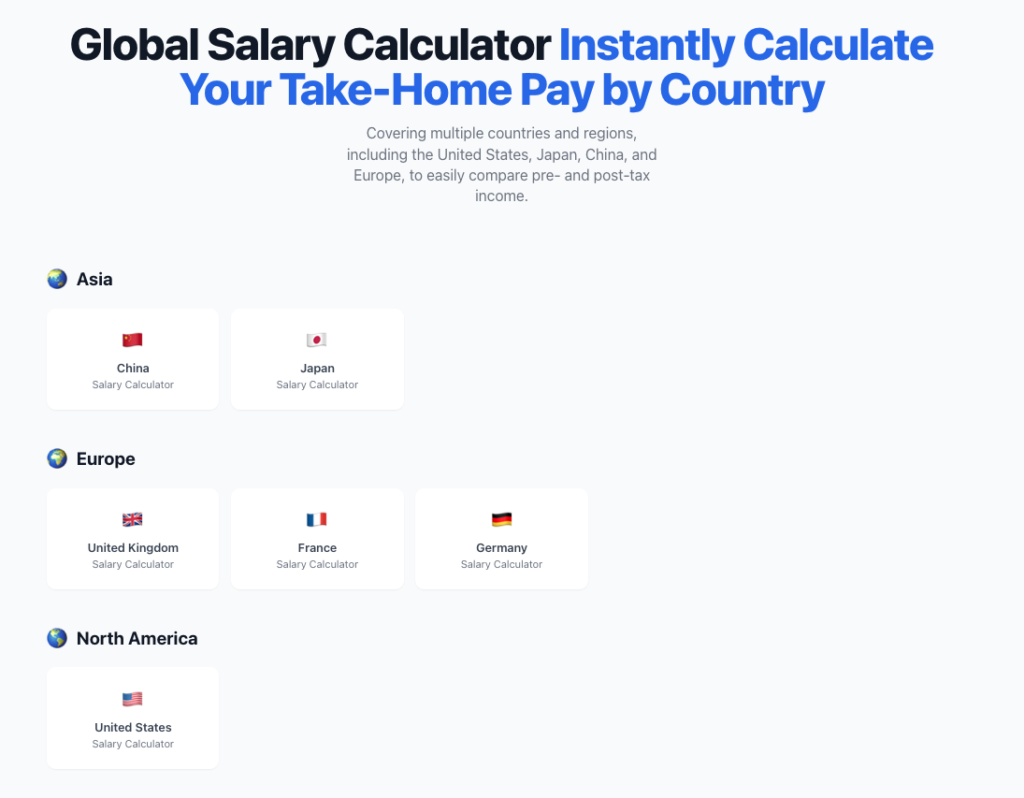

The platform currently supports salary calculations for several major economies, including the United States, the United Kingdom, France, Germany, Japan, and China. Each calculator reflects country-specific tax regulations and contribution structures, allowing users to compare how similar gross salaries may result in different net income outcomes depending on location.

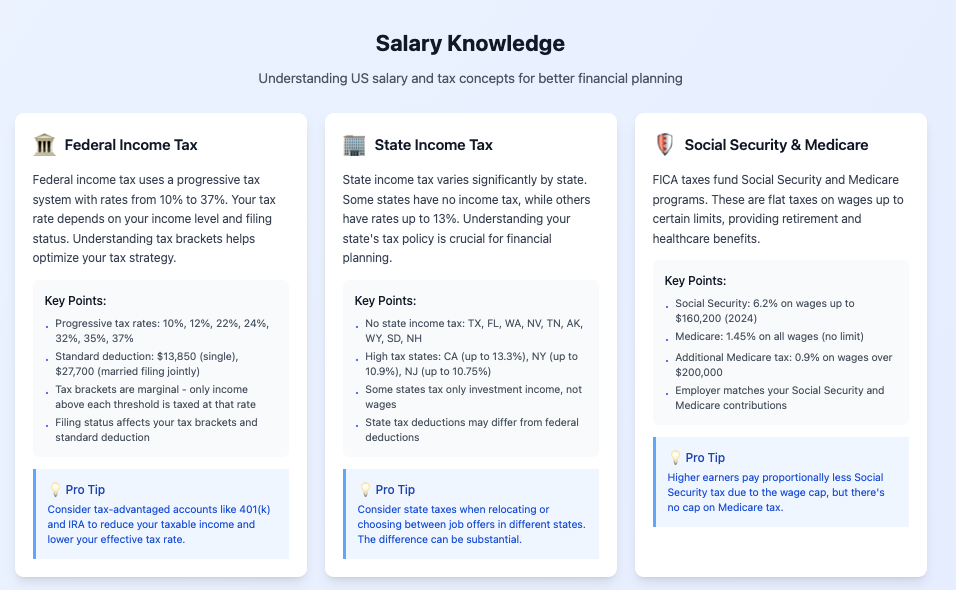

For U.S.-based users, the calculator also accounts for mandatory payroll deductions such as the FICA tax, which includes Social Security and Medicare contributions.

SalaryCalculator.ai noted that modern payroll systems often include multiple layers of deductions beyond income tax, such as healthcare contributions, pension payments, unemployment insurance, and housing-related funds. The platform presents these deductions in a structured format to help users better understand how individual components contribute to overall take-home pay.

According to the company, the tool is commonly used for evaluating job offers, planning international relocations, and estimating post-tax income for remote and freelance work arrangements. By providing side-by-side comparisons across regions, the platform aims to support more informed financial and career planning decisions.

The company also emphasized the educational aspect of the platform, stating that visual breakdowns of payroll deductions can improve general payroll awareness and financial literacy, particularly for users unfamiliar with international tax systems.

SalaryCalculator.ai stated that while the calculations are based on current tax data and standard assumptions, results are estimates and may vary depending on factors such as marital status, dependents, benefits, and regional variations. Users are encouraged to treat the outputs as reference information rather than definitive tax determinations.

Additional information about SalaryCalculator.ai and its country-specific salary calculators is available on the company’s website.

About SalaryCalculator.ai

SalaryCalculator.ai is an AI-powered salary and tax calculation platform designed to help users understand how gross income converts into net earnings across different countries. The platform provides country-specific calculators and structured deduction breakdowns to support informed salary comparisons, financial awareness, and career planning in a global employment environment.

Media Contact

Name: Jessie

Organization: salary-calculator

Website: https://salary-calculator.ai/